A “crypto wallet” is a digital tool that securely stores the private and public keys used to access and manage cryptocurrencies.

It is a wallet-like online device, but instead of holding cash or cryptocurrency, it is used to save the passwords that provide access to digital currencies like Bitcoin, Ethereum, and Litecoin.

Putting it in another way, a Crypto wallet contains the passwords that are unique keys, allowing the transaction of cryptocurrency in a user’s account. These keys secure data holdings on the decentralized ledger called Blockchain. Crypto wallets may not necessarily be software apps developed by mobile app development companies; they can even be hardware devices.

When discussing crypto wallets in terms of internet connectivity and usage, they are typically classified as either hot wallets or cold wallets. Hot wallets are connected to the internet and offer ease of access for frequent transactions, while cold wallets operate offline and are considered more secure due to their reduced exposure to cyber threats.

Again, based on the custody of keys, crypto wallets can be categorised as custodial or non-custodial.

A non-custodial wallet allows users to retain full control of their private keys without involving any third party. The user holds and manages the keys directly, typically storing them on their device, ensuring complete ownership and access to the decentralized network.

A custodial wallet, on the other hand, requires a delegation to a third party that is centralized and stores the keys.

Some people prefer non-custodial keys because they view custodial keys as a potential risk, given that access is controlled by a third-party software provider.

Whereas the user directly has control of the key in a non-custodial wallet.

Also Read: Is WazirX Safe? Learn to Build a Legal Crypto Exchange App

What is a Custodial Wallet?

A custodial wallet is said to be a digital vault where a supplier of this wallet acts as a guardian to your key. You may then not remember the password. The third party now stores it in the form of a key.

A user then needs to log in to the user account with the credentials for that central business third party and needs to enter the address. It will then send you the key to perform the transaction.

Some of the best Custodial Wallets are

- Binance

- Kraken

- BitGo

- Circle

- BlockFi

- Robinhood

These custodial wallets are controlled and managed by the organizations that must meet certain requirements before incorporating. Also, a KYC is performed for the users to verify their identities.

A survey published by Verified Market Research states that the Custodian Wallet Market will touch USD 7.2 billion by 2033, which in 2024 was USD 1.2 billion.

Pros of Custodial Wallets

- Easy Usage – The custodial wallets are easy to use since it does not require a lot of setup, and the third party takes care of storing the keys.

- Customer Service – Since custodial wallets are the organization’s, they have customer representatives who help you in case you face any difficulty.

- Recovery or Backup – In case of any technical issues, a backup or recovery is provided to assist you better and help you retrieve data.

- Insurance Against Hacking – Custodial wallets offer an insurance layer if your key or cryptocurrency is hacked.

Cons of Custodial Wallets

- Loss of Control – If you choose the custodial wallets, you might then lose your full control to a third party. In case you want to perform a transaction, the user might need to undergo verifications and approvals.

- Security Risks – Custodial Wallets are more prone to threats and hacks since it is a centralized network. You are susceptible to data loss in such cases.

- Limited Compatibility with Cryptocurrencies – A few custodial wallets are not compatible with all cryptocurrencies, and so you might miss out on investing in some.

What is a Non-Custodial Wallet?

Non-custodial wallets provide authority to users to store the keys. There is no interruption of any organization or another party in a non-custodial or “self-custody” wallet. A private key is used to perform transactions in the crypto ecosystem. This key serves as a password composed of a random sequence of characters, forming a string.

Some of the best Non-Custodial Wallets are

- MetaMask

- Electrum

- Phantom Wallet

- Trust Wallet

- MyEther

- Atomic

Pros of Non-Custodial Wallets

- Control over Keys – A user is not dependent on any third party and has full control over their keys since they are their bank.

- Faster Transaction – Since a non-custodial wallet skips the authorization, two-step verification, and approval requests to be performed, it records a shorter transaction time.

- Fund Security – Non-custodial wallets offer enhanced security for your assets, which is why they are the preferred choice for most experienced traders. It is due to the non-existence of a centralized authority that holds the key and has more hacking/theft issues.

Cons of Non-Custodial Wallets

- More Responsibility – A non-custodial wallet accounts for more responsibility, as you are the sole owner performing all operations from scratch.

- Losing Data Via Key – In case you lose a key, all your data is gone, which might be tough to recover, as there is no insurance or any party responsible.

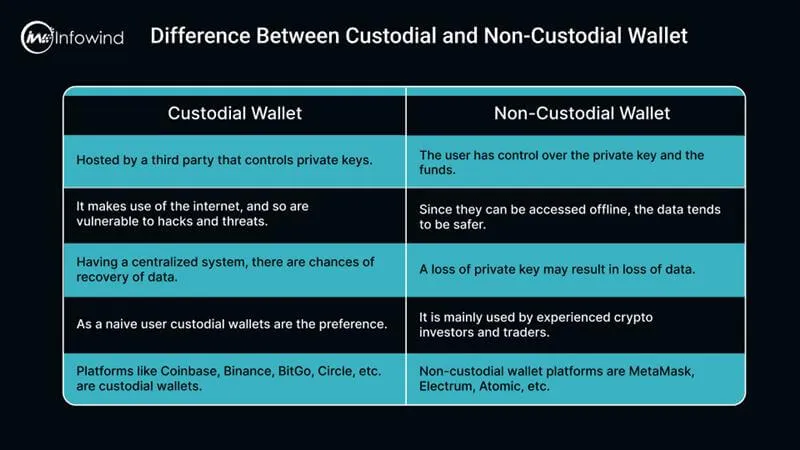

Custodial vs Non-Custodial Wallets: Key Differences Table

It has been a debatable conversation to choose between a Custodial and a Non-custodial wallet. Let’s understand both with a tabular representation of the difference between a non-custodial and custodial wallet.

Custodial Wallet | Non-Custodial Wallet |

| Hosted by a third party that has full control of your private keys, including access to funds. | The user has control over the private key and the funds. Also called a “Self-custody” wallet. |

| It makes use of the internet, and so is vulnerable to hacks and threats, therefore reducing the security of the funds. | Since they can be accessed offline, the data tends to be safer and is less prone to cyberattacks. |

| Having a centralized system, there are chances of recovery of data in case you lose the key or any issue in transactions. | You are the bank, and having a loss of private key may result in loss of data, and no recovery is possible. |

| As a naive user and no technical knowledge, custodial wallets are the preference. | It is mainly used by experienced crypto investors and traders who have good technical knowledge. |

| It requires KYC and AML to be done while setting up an account. Also, the transactions take time to perform since they involve two-step verification and approvals. | Straightforward accounts can be created, which is a fast process. |

| Platforms like Coinbase, Binance, BitGo, Circle, etc. are custodial wallets. | Non-custodial wallet platforms are MetaMask, Electrum, Atomic, etc. |

When to Use a Custodial Wallet

Custodial wallets are used mainly by beginners in cryptocurrency trading and investing. A platform or exchange like Coinbase or Binance wallets makes it easy to use. Users who want a centralized system for their key management to make the process less cumbersome generally use a custodial wallet.

It is also used by businesses or enterprises that require multi-user login. Also, people who are less technically sound opt for the custodial wallets as their data and keys are centralized, promising insurance in case of theft.

When to Use a Non-Custodial Wallet

A non-custodial wallet is used when a user has a priority of having full access and control over the private key and data over the network. If security is a primary concern, then a non-custodial wallet is always the choice for users. Also, interaction with decentralized apps like DeFi requires a self-custody vault. Users who want to have long-term holdings go for this wallet; it is considered safer and secure.

Common Misconceptions Debunked

“Custodial wallets are safer.”

Custodial wallets are a safe storage for cryptocurrency, but if you are a beginner and you do not know a lot about the technicalities, and may not be able to manage the private keys, it may be a better choice. But these wallets are not considered to be safe. Since it is managed by a platform and makes use of the internet, your data, key, and crypto are at a higher risk. Also, if the exchange declares bankruptcy, all your funds vanish. Hacks and attacks are another reason that can make the custodial wallets less safe.

Does “Non-custodial mean anonymous”?

Anonymous, put into simple words, means that the identity is not revealed. The non-custodial wallets keep the keys secret. It is managed by the user, and so they are private, but it does not make it anonymous. The transactions performed do not guarantee anonymity.

How to Choose the Right Wallet for You?

There’s a difference between custodial and non-custodial wallets. Choosing between these wallets depends on some factors. Considering the “Risk Tolerance” factor, non-custodial wallets are considered safer than custodial wallets, and so the risk associated with non-custodial wallets remains on the lower side.

When considering the level of technical expertise required, beginners in the crypto space should opt for custodial wallets. Flipping the coin, if an experienced user is in the league, then non-custodial wallets are always a good choice for them.

Based on the amount and type of crypto assets, if you hold some Bitcoin or any currency in small amounts, non-custodial wallets are better, but for a large investment amount, a hard wallet or cold storage is generally preferred by investors. Moreover, custodial wallets undergo all the KYC and AML processes in advance, and the platform is the manager; hence, it offers a smooth process for fiat currency.

Conclusion

Spotting the light on custodial vs. non-custodial wallets, we have tried to highlight the importance of both types of wallets. Holding your cryptocurrency key is always an option in the above two. Experts, however, choose the non-custodial wallets, but every user must ensure to have a clear picture of their needs before choosing.

As an enthusiastic investor in the beginning, you should opt for a custodial wallet. A multiple-wallet approach is another technique to safeguard your keys. The above wallets have one blockchain, but multi-chain wallets offer multiple blockchains, ensuring enhanced security.

At the end, there’s a suggestion for all our readers to be a brainstormer and keep reading, learning, and being informed about the changes in the crypto ecosystem so that you can upgrade with the best.